All Categories

Featured

Table of Contents

Insurer will not pay a minor. Instead, take into consideration leaving the money to an estate or trust. For more comprehensive information on life insurance policy get a duplicate of the NAIC Life Insurance Policy Customers Overview.

The IRS puts a restriction on just how much money can go right into life insurance policy premiums for the plan and how swiftly such premiums can be paid in order for the policy to preserve all of its tax obligation advantages. If certain limitations are exceeded, a MEC results. MEC insurance policy holders may be subject to tax obligations on circulations on an income-first basis, that is, to the level there is gain in their policies, as well as charges on any taxed amount if they are not age 59 1/2 or older.

Please note that impressive loans accumulate interest. Income tax-free therapy additionally assumes the funding will become satisfied from income tax-free death advantage profits. Finances and withdrawals reduce the plan's cash money worth and fatality advantage, might create certain policy benefits or riders to become not available and may enhance the chance the plan might gap.

4 This is provided via a Long-term Care Servicessm rider, which is readily available for a service charge. Additionally, there are restrictions and restrictions. A customer might get the life insurance, yet not the rider. It is paid as a velocity of the death benefit. A variable universal life insurance agreement is an agreement with the key purpose of providing a survivor benefit.

What is Guaranteed Benefits?

These profiles are closely managed in order to please stated investment goals. There are charges and fees associated with variable life insurance policy agreements, consisting of mortality and threat fees, a front-end load, management costs, financial investment monitoring fees, surrender fees and fees for optional bikers. Equitable Financial and its associates do not supply legal or tax obligation guidance.

And that's great, because that's specifically what the death advantage is for.

What are the benefits of whole life insurance policy? Below are several of the crucial things you should understand. One of the most attractive advantages of purchasing a whole life insurance policy policy is this: As long as you pay your premiums, your survivor benefit will certainly never ever end. It is assured to be paid regardless of when you die, whether that's tomorrow, in 5 years, 80 years and even further away. Mortgage protection.

Believe you do not need life insurance policy if you do not have children? You may desire to reconsider. It may appear like an unneeded expense. There are several advantages to having life insurance coverage, also if you're not sustaining a household. Below are 5 reasons you must buy life insurance policy.

Retirement Security

Funeral expenses, burial costs and medical expenses can add up. Irreversible life insurance is offered in various amounts, so you can select a death benefit that satisfies your requirements.

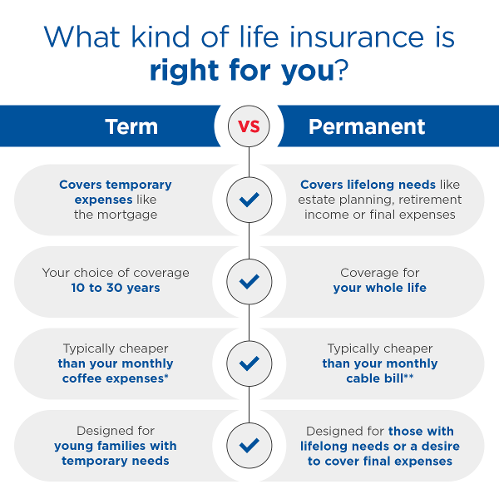

Determine whether term or permanent life insurance is best for you. Get a price quote of just how much coverage you may need, and exactly how much it could cost. Find the correct amount for your budget and peace of mind. Find your amount. As your personal situations adjustment (i.e., marital relationship, birth of a youngster or work promotion), so will certainly your life insurance needs.

Essentially, there are 2 kinds of life insurance coverage plans - either term or long-term strategies or some combination of both. Life insurers provide numerous types of term strategies and standard life policies along with "passion sensitive" items which have actually come to be more common considering that the 1980's.

Term insurance policy provides protection for a given time period. This period might be as short as one year or give protection for a certain number of years such as 5, 10, twenty years or to a defined age such as 80 or in some cases up to the oldest age in the life insurance coverage mortality.

Who offers flexible Protection Plans plans?

Presently term insurance rates are extremely competitive and among the most affordable traditionally experienced. It should be noted that it is an extensively held belief that term insurance is the least pricey pure life insurance policy protection offered. One needs to assess the policy terms meticulously to choose which term life options are suitable to satisfy your specific conditions.

With each brand-new term the premium is increased. The right to renew the plan without proof of insurability is an essential advantage to you. Or else, the risk you take is that your health and wellness may wear away and you may be unable to get a plan at the exact same rates or perhaps in any way, leaving you and your recipients without protection.

The length of the conversion duration will vary depending on the type of term policy acquired. The costs rate you pay on conversion is typically based on your "current achieved age", which is your age on the conversion day.

Under a degree term plan the face amount of the policy stays the same for the whole duration. With lowering term the face quantity minimizes over the period. The premium remains the exact same every year. Usually such policies are marketed as mortgage defense with the amount of insurance coverage decreasing as the equilibrium of the home loan decreases.

Why should I have Retirement Planning?

Traditionally, insurance providers have actually not can change costs after the policy is sold. Considering that such policies may proceed for several years, insurers have to utilize conservative death, passion and cost price quotes in the costs calculation. Adjustable costs insurance, nevertheless, allows insurers to supply insurance at reduced "existing" costs based upon less traditional assumptions with the right to alter these costs in the future.

While term insurance coverage is designed to provide protection for a defined time period, permanent insurance policy is developed to provide coverage for your entire life time. To maintain the premium rate degree, the costs at the more youthful ages surpasses the actual cost of defense. This additional costs builds a book (money worth) which helps pay for the policy in later years as the price of protection rises above the costs.

Under some policies, premiums are called for to be spent for a set number of years. Under various other policies, premiums are paid throughout the insurance policy holder's life time. The insurance policy business spends the excess premium bucks This kind of plan, which is in some cases called cash money worth life insurance, generates a savings component. Cash worths are crucial to a long-term life insurance coverage plan.

Latest Posts

Low Cost Burial Insurance For Seniors

Online Funeral Quote

Top Final Expense Carriers